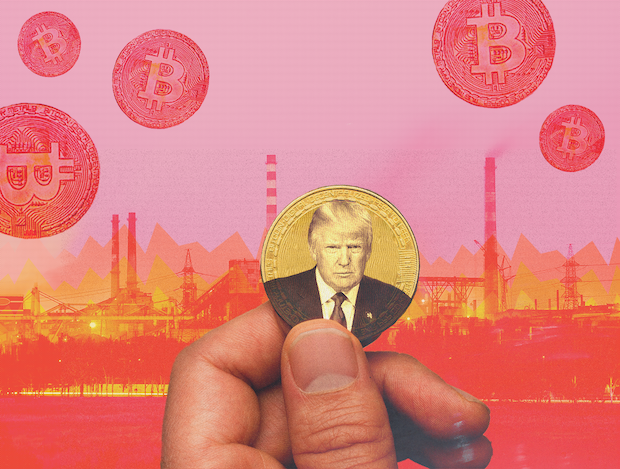

How Trump’s Crypto Dealings Threaten Democracy — and the Planet

Published Jun 11, 2025

Donald Trump’s crypto schemes aren’t just corrupt — with crypto’s sky-high environmental impact, they’re also endangering our health and environment.

Handing a check to the president in exchange for his time — and even favorable policies — is textbook corruption. And while Trump hasn’t been that brazen, he’s coming the closest he’s ever gotten with his crypto schemes.

Cryptocurrency is a digital form of money, marketed by supporters as an alternative to traditional banking and government. Transactions rely on blockchains, the decentralized and shared public networks that store transactions.

Many types of crypto (there are tens of thousands) have become hotbeds for scams and speculation — the president himself has said they’re “highly volatile and based on thin air.”

But in the past year, Trump has changed his tune. He has become a major advocate for bringing cryptocurrencies to the mainstream. At the same time, his family and their affiliates have expanded crypto ventures that enrich Trump.

If he succeeds in “mainstreaming” crypto, he’ll not only open the doors to more corruption. He’ll also expand an incredibly harmful industry with big impacts on our health, climate, resources, and economic well-being.

A growing boom wouldn’t just enrich Trump and crypto kingpins — dirty energy companies will benefit, too, while the rest of us are left holding the bag.

Trump’s Meme Coin Corruption Scheme

There are thousands of kinds of cryptocurrencies; you might have heard of the most common one, Bitcoin. This year, Trump released his own coin right before inauguration day.

The Trump coin (stylized as “$TRUMP”) is a meme coin, a crypto asset closer to a Beanie Baby than any kind of currency. Meme coins are a novelty item associated with an internet trend, and they have no economic or transactional value.

Their price isn’t based on anything but popularity. This makes them very volatile, as those prices can change on a dime. Investing in meme coins is speculative; it’s basically a gamble that you’ll buy when the price is low and sell when it rises, making a profit.

For example, CNN reports that $TRUMP went from $6.50 at launch to $75 just two days later. At that point, Trump’s wealth from the coin surged to $56.6 billion. In more recent weeks, the price has been in the $10-15 range.

When $TRUMP saw a slump in April, Trump drove it up again when he announced he’d host a dinner with the 220 people who own the most of the coin. The deal was clear: buy Trump’s crypto (which he benefits from financially) and get access to the President. The coin’s price quickly rose nearly 60%.

At launch, affiliates of the Trump Organization owned 80% of $TRUMP coins. This means that any growth in the coin’s value largely benefits those firms. But Trump doesn’t just win if $TRUMP prices rise; he also benefits with every transaction.

In less than two months, shadowy firms connected to Trump have made an estimated $350 million in $TRUMP trading fees.

Trump Opens the Gates for the Crypto Industry

The President has now fully embedded himself in crypto world. Less than two months before the 2024 election, he launched World Liberty Financial, a company that trades in crypto. A Trump-affiliated company has a 60% ownership stake in World Liberty and takes in 75% of net revenue from coin purchases.

And while Trump makes a fortune from crypto, his administration is also working to make U.S. policies more crypto-friendly — a glaring conflict of interest.

Notably, World Liberty now issues a “stablecoin,” a cryptocurrency whose value is pegged to a real-world asset (in this case, the dollar). Boosters argue that this will make stablecoins more practical for everyday transactions.

Just a week before World Liberty announced its new stablecoin, Trump called on lawmakers to pass legislation to govern and legitimize stablecoin.

Under Trump, the Securities and Exchange Commission (SEC) has paused investigations into a dozen crypto companies. The Department of Justice recently disbanded a team going after crypto criminals, and the new chairman of the SEC is a crypto advocate.

More recently, the Trump administration rolled back Biden-era guidance to keep crypto deposits out of banks and crypto investments out of retirement accounts.

Trump also issued an executive order to promote crypto’s growth and another instructing the Treasury Department to create a government crypto stockpile. (World Liberty’s crypto holdings jumped in value when he announced the stockpile would include a coin that the company had invested in.)

If Trump gets his way, crypto will sneak into our everyday lives. And this all makes even more sense once you know that crypto donors spent millions electing him.

Food & Water Watch shares the news and analysis you need to fight for a livable future. Get our latest in your inbox.

Crypto Makes Our Energy Dirtier and More Expensive

A rise in crypto spurred on by Trump’s support doesn’t just open the door to corruption. It will also enrich Big Oil and Gas, worsen the climate crisis, hog essential resources, and drive more pollution and higher prices.

That’s because cryptocurrencies are incredibly energy-intensive. Coins are often “mined” through a process known as “proof of work,” which requires a powerful computer to solve complex mathematical puzzles.

The first to solve the puzzle is awarded cryptocurrency, incentivizing crypto “miners” to have the biggest, most powerful (and most energy-intensive) computers. Moreover, these computers must run nonstop to maximize profit, increasing demand on the energy grid.

In 2021, mining a single Bitcoin (the most popular cryptocurrency) required the same amount of energy as the average household uses in nine years. Bitcoin mining’s annual energy use is comparable to that of countries like Poland and South Africa.

Crypto’s energy requirements have revived coal plants and driven partnerships with Big Oil and Gas. Fossil fuel giants like ExxonMobil and ConocoPhillips have teamed up with miners.

States have even begun passing tax breaks for oil companies that provide gas to crypto miners instead of flaring, or burning it off. The crypto boom’s use of fossil fuels has led to more dangerous air pollution, even for those hundreds of miles away from mining sites.

Moreover, research shows that crypto mining’s demand raises energy prices for its neighbors. Nevertheless, many states are throwing lucrative tax giveaways and electricity discounts at crypto miners to entice them to set up shop.

Crypto Benefits Billionaires, Not Us

Besides the energy impact, cryptocurrency mining also has major effects on water and the environment. Many mining centers rely on lots of water to cool these super-powerful, super-hot computers.

Additionally, the nature of proof of work creates massive amounts of toxic e-waste. The hyper-specialized, hyper-powerful devices needed for mining are quickly burned through and then tossed.

All this, on top of increasing fossil fuel pollution and energy costs, makes the stakes clear. Crypto-mining endangers our most precious resources, and we pay the price. Meanwhile, developers, crypto firms, dirty energy companies, and crypto’s wealthiest backers — including Trump — are making bank.

While crypto may feel like a mysterious phantom for many, the country’s richest are exploiting it to reap huge rewards for themselves. Unrestrained, we can expect things to get worse. Trump certainly seems determined to make this a reality.

His push for crypto is yet another piece of his billionaire agenda and another scheme to enrich himself at the expense of all else — including our planet and our livable future.

Enjoyed this article?

Sign up for updates.

TO TOP